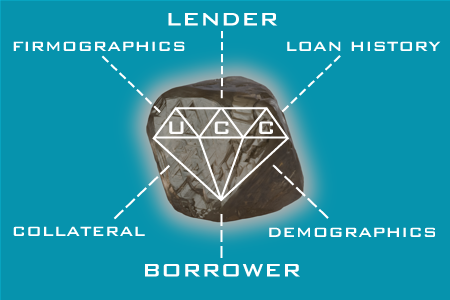

Every UCC-1 filing is like a diamond in the rough. It’s greatest value to direct mail marketers emerges with processing and refinement. Monitoring UCC filing data activity can open a potent portal to fresh financing opportunities for lenders, and sales leads for providers of goods and services.

UCC Filing Data Can Answer Critical Questions:

- Who is the lender and the borrower?

- What is the debtor’s business status?

- When was the filing initiated, and when does the debt mature?

- Where are the borrower and lender are located?

- Why was the financing was needed?

- How is the loan secured?

UCC filings have grown to represent a prized source of targeting data for direct mail marketers selling goods or services locally and nationally, across demographic and firmographic divides.

While the entire UCC database is available as a matter of public record on a state by state basis, it is vast and fragmented. Local databases may not be maintained in standard formats. Engaging with a data professional who is equipped to format, extract, and navigate the data, in whatever form it exists becomes key. Plus, in the event that a particular piece of data is absent, data appends can be provided to ensure records are complete as required.

UCC Filings Can Identify Merchant Cash Advance Leads

Startups, sole proprietors, and local merchants have often sought financing in the form of Merchant Cash Advance loans. These business people are well aware of the ground rules for such financing and often have a documented MCA borrowing history. The critical details of these loan transactions are available as UCC filing data. Most important, they may need fresh financing in the near future.

UCC data has become such a valuable asset to direct mail marketers for good reason. To learn more about how UCC data can enhance your marketing efforts, please call us at (914)948-8300. You may submit a request for data and information as well.