Business Lending Databases – Growing Loan Portfolios

Business lending has recovered greatly since the Great Recession. Competition for qualified prospects is up. Successful direct mail business loan marketing must be customer centric: well conceived, and powered by fresh, accurate business lending databases. Lenders need to understand the prospective borrower’s journey from awareness to application.

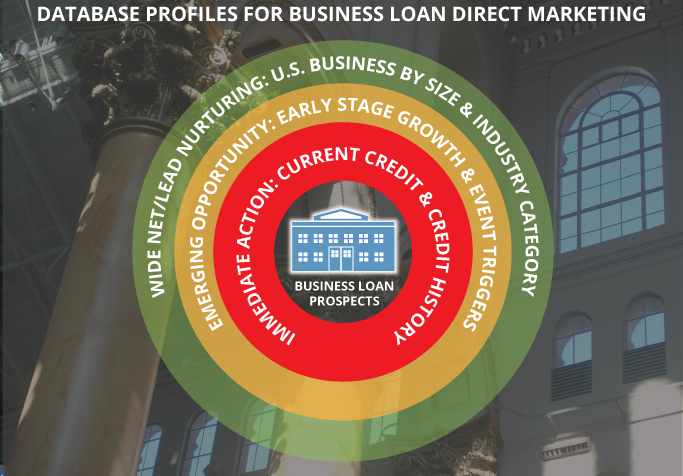

Mailinglists.com guides business lenders through their own customer prospecting and/or retention journey. Our range of rock solid business databases covers the gamut of targeting goals:

Immediate Action: Current Credit & Credit History – Some lenders insist on stellar histories. Others are willing to take greater credit risks. Or maybe provide Merchant Cash services. All can get fresh, accurate UCC-based data, selecting for the credit profile that makes sense for them.

Emerging Opportunity: Early Stage Growth & Event Triggers – Startup costs, expansion, infrastructure, inventory, marketing and HR costs drive new business borrowing. Changes to ongoing businesses – both planned and unexpected – are triggers of funding needs.

Wide Net/Lead Nurturing: U.S. Business By Size & Industry Category – Target the greatest number of credit prospects of all sizes within the U.S. business community. The wide variety of selectors lats you pick the businesses and executives most likely to respond to your offer.

Reach the right audience with the right offer at the right time via the right channel. Download “Business Lending Databases: Growing Loan Portfolios” to for more depth on the stable of business databases we offer to help loan marketers hone their audience lists. Call us at (914) 948-8300 or submit the form to learn about our business lending databases and B2B mailing list services.

CALL (914) 948-8300 Or Fill Out And Submit The Form Below To Start Getting Better List Data.